In 2023, electric vehicle (EV) and hybrid vehicle (HEV) sales in the United States are expected to reach 1.2 million units, a 60% increase from 2022.

Sales of electric vehicles jumped 60% in the United States in the first quarter of 2023 compared to last year, propelling the country into the world's second-largest electric car market, behind China. Tax credits played a crucial role in this increase, which is expected to continue in the coming years.

This growth is due to several factors, including

The continued rise in gasoline prices encourages consumers to look for more affordable alternatives.

The increasing availability of more affordable EV and HEV models, such as the Chevrolet Bolt EV and Toyota Prius.

Government policies that encourage the purchase of EVs and HEVs, such as the federal $7,500 EV tax credit and the $2,500 HEV tax credit.

By 2023, EVs are expected to account for 8% of light vehicle sales in the United States, while HEVs are expected to account for 5%.

Here are the most popular EV brands and models in the United States in 2023

- Tesla Model 3

- Tesla Model Y

- Ford Mustang Mach-E

- Chevrolet Bolt EV

- Toyota Prius

Here are the most popular HEV brands and models in the United States in 2023:

- Toyota Prius

- Toyota Camry Hybrid

- Honda Accord Hybrid

- Honda Insight

- Hyundai Sonata Hybrid

Sales of hybrid, plug-in hybrid, and battery-electric vehicles in the United States have increased in recent years, while sales of non-hybrid gasoline or diesel vehicles have declined. In the second quarter of 2023, hybrid, plug-in hybrid and battery-electric cars collectively accounted for 16% of U.S. light-duty vehicle sales, according to data from Wards Intelligence.

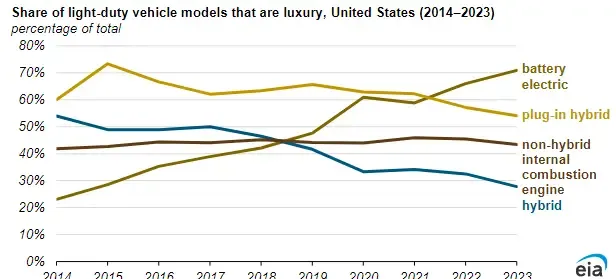

Much of the increase in sales is due to new offerings from manufacturers in different market segments, although existing models also account for part of the increase in sales. Manufacturers reduced the number of non-hybrid internal combustion engine (ICE) vehicle models from 318 to 297 between 2021 and 2Q23, and increased the number of battery electric models from 34 to 55. In this context, only a vehicle model includes a nameplate and all available trim levels associated with that nameplate.

The luxury vehicle market accounted for 18% of total new vehicle sales in 2Q23, up from 14% in 2020. Most of the transition to battery-electric models is in the luxury segment. Manufacturers removed 17 non-hybrid luxury ICE vehicle models and added 19 battery-electric luxury models between 2021 and 2Q23.

Battery electric vehicles now make up 20% of all luxury models available, compared to 7% of non-luxury models. Model availability is an indicator of consumer acceptance within a market segment. In 2Q23, battery electric vehicles accounted for 32% of total luxury sales and just over 1% of non-luxury sales. Sales data from market segments indicates that buyers of luxury vehicles are more willing to pay higher prices for electric vehicles than buyers in non-luxury markets.

Reference :

Wards Intelligence

EIA : Energy Information Adminisration